Namo namaha, finance explorers!

Indian affiliate link

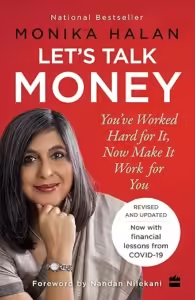

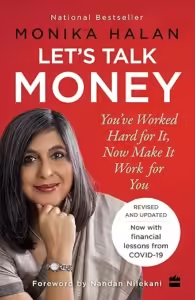

“You’ve worked hard for it, now make it work for you.” Monika Halan’s book Let’s Talk Money opens with this simple yet powerful statement, cutting straight to the core of our relationship with money! How many of us excel at earning but falter at the crucial next step – making our money grow?

Her dedication spotlights an all-too-familiar reality for Indian salaried professionals: “To the Indian income tax payer. You pull hard for those that don’t.” We’re diligent about earning and paying our dues, but what about making the money that remains, work harder for us?

As a salaried professional myself, I’m all too familiar with the drill: pay first-world tax rates while navigating third-world infrastructure! We put in the hours, pay our taxes diligently, yet managing our finances often feels like an uphill battle. The usual advice? Track every single rupee, build complex spreadsheets, or adhere to rigid budgeting rules. But after a long day, who has the energy for that?

What if there was a better way? Enter the Money Box System—Monika Halan’s refreshingly straightforward and practical framework that promises to streamline your entire financial life, not just your monthly expenses. Think of it as building a system that runs effortlessly in the background, allowing you to focus on what truly matters.

What is the Money Box System?

The Money Box System is not just about budgeting; it’s about building a framework that manages your entire financial life and runs on autopilot, freeing up your time and mental energy! Halan argues that “Most financial planning fails because we don’t have an efficient cash flow system in place”.

The Money Box system addresses this by creating distinct compartments for different financial needs:

Cash Flow Management: A setup to track your income and expenses, ensuring that you allocate money effectively.

Emergency Fund: A crucial fund to protect yourself from unexpected financial shocks.

Insurance Protection: Essential components of a sound financial plan, providing a safety net for you and your family.

Investments: Key to building long-term wealth for your future goals, such as retirement or your children’s education.

An Example of the Money Box System in Action

To illustrate how the Money Box System works, let’s look at the example of Maya, a 35-year-old software engineer, earning ₹15 lakhs annually in Bangalore.

Maya‘s Current Financial Situation:

Supports aging parents (₹20,000 monthly for their expenses)

Contributes ₹15,000 monthly for her sister’s college education

Has various bank accounts with scattered savings

Maintains an Excel sheet but rarely updates it

Has basic insurance policies but isn’t sure if they’re adequate

Plans to buy a house in 5 years (needs ₹20 lakhs for down payment)

Needs a retirement plan

Monthly Financial Snapshot:

Take-home pay: ₹1,00,000

Regular expenses: ₹60,000 (includes family support)

Ad-hoc expenses: ₹20,000-30,000

Random savings: Whatever’s left

Setting Up the Money Box

Using the Money Box System, Maya first sets up three accounts:

Using the Money Box System, Maya first sets up three accounts:

- Income Account: Salary credited here

- Spend-it Account: ₹70,000 transferred monthly (includes buffer)

- Invest-it Account: Remaining ₹30,000 automatically transferred

For more details on implementing the Money Box System, I recommend picking up a copy of “Let’s Talk Money” by Monika Halan. The book provides a wealth of practical advice and guidance on setting up and managing your personal Money Box System.

Within 6 months of implementing this, Maya has:

- Emergency fund building up in ultra-short-term debt fund

Term insurance purchased (₹1.5 crores – covering future home loan and family responsibilities)

Medical insurance upgraded to family floater

SIPs started for house down payment

Parents’ and sister’s expenses properly budgeted

Random spending reduced due to clear boundaries

How Money Box Differs From Other Systems

Most popular financial management systems like the envelope method or the 50-30-20 rule focus primarily on budgeting – helping you manage current expenses and perhaps save what’s left. The Money Box System takes a more comprehensive approach.

Think of it this way:

Traditional systems answer: “How do I manage my monthly expenses?“

Money Box answers: “How do I manage my entire financial life?“

The Money Box System:

Creates a complete financial framework – from emergency funds to retirement

Builds protective layers through insurance and emergency funds

Addresses both current needs and future goals

Helps you select appropriate financial products for each need

Works with human psychology rather than against it

As Halan emphasizes in the book, “The mistake most people make is to think of the money box only as a container of investment products… But ‘what to invest in‘ is not the first decision we should take.“

Bringing It All Together

Global affiliate link

The Money Box System offers a comprehensive approach to personal finance management. By creating a clear framework for your money and automating your cash flows, you can simplify your financial life and focus on what matters most.

As Monika Halan emphasizes in Let’s Talk Money, the key is to make your money work for you. This framework provides a practical way to do just that, aligning your resources with your goals and values.

Remember, financial transformation is a journey, not a destination. Start where you are, take small steps, and stay consistent. Over time, those incremental changes can lead to significant improvements in your financial well-being.

Your Turn!

I’m curious to hear your thoughts on the Money Box System. For those who have read Let’s Talk Money, what were your key takeaways? And if this post was your introduction to the concept, did it inspire you to learn more?

Have you tried other financial management systems before? What worked and what didn’t? Share your experiences in the comments below or connect with me on my social channels. Let’s continue this conversation about building better money habits together.

Om Shanti!🙏